Sales invoice vs. official receipt: what should your food business issue? In the Philippines, these two documents are distinct despite their similar functions, playing a crucial role in keeping records organized and ensuring compliance with local tax laws. However, the Bureau of Internal Revenue (BIR) recently implemented changes under the Ease of Paying Taxes (EoPT) Act, requiring sales invoices for goods and services, replacing the previous use of official receipts for service-based transactions.

If you're wondering what this means for your business and how to issue the correct document, this guide covers everything you need to know. Read on to understand the key differences between invoices vs. receipts, the latest BIR regulations, and how to ensure compliance.

What Is a Sales Invoice?

A sales invoice is the primary tax document that records the sale of goods and services. It includes transaction details such as:

- An itemized list of food or services sold

- Description of goods or services

- Quantity and unit price

- Total amount paid

- Applicable taxes (VAT or non-VAT)

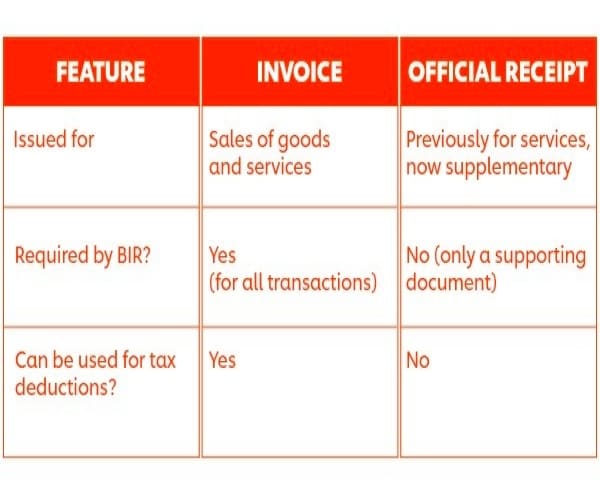

Sales invoices serve as the official proof of transaction for tax purposes. Under the new BIR rules, invoices are now required for both product sales and service transactions, eliminating the previous use of official receipts for services. Dine-in, takeout, and delivery transactions all require this invoice.

What Is an Official Receipt?

An official receipt (OR) was previously the required document for service-based businesses. However, under BIR Revenue Regulations No. 7-2024, official receipts are now considered supplementary documents rather than the primary proof of sales.

Although businesses may still use ORs as part of their records, only sales invoices will be recognized as the official proof of a taxable sale.

What Is a Collection Receipt?

A collection receipt is a supplementary document issued to acknowledge a payment received. Unlike a sales invoice, it does not serve as the main tax document. Businesses often issue collection receipts when accepting deposits, advance payments, or partial payments from customers. For example, if a customer pays a deposit for a catering event, you may issue a collection receipt for the deposit. When the full payment is made, issue a sales invoice as the final proof of sale.

While collection receipts help track cash flow, they cannot be used as proof of sales for tax reporting purposes.

BIR’s New Directives: What You Need to Know

Here’s what food businesses must do to stay compliant with the Ease of Paying Taxes (EoPT) Act:

1. Transition from official receipts to service invoices.

Businesses must issue invoices for all sales, whether for goods or services. If you previously used ORs for services, you must switch to invoices to comply with the law. To ease the transition, the BIR allowed businesses to convert unused official receipts into invoices by striking through the term "Official Receipt" and replacing it with "Invoice."

2. Mandatory inventory submission of unused official receipts.

Businesses must submit an inventory report of their unused official receipts to the BIR. This report should include the number of remaining receipt booklets and serial numbers of unused official receipts. Failing to submit this report could result in penalties, so businesses should act promptly.

3. Updating accounting and sales systems.

If your business uses a Computerized Accounting System (CAS) or Computerized Books of Accounts (CBA), the system must be updated to replace "Official Receipt" with "Invoice" and reflect the new invoicing structure in sales records.

4. Employee training on the new invoicing process.

To ensure a smooth transition, businesses must educate their staff, particularly those handling sales and accounting, on the new invoicing process. Employees should understand:

- When to issue a sales invoice

- How to process converted official receipts

- How to record transactions accurately under the new rules

5. Implementation of the electronic invoicing system (EIS).

The BIR has also mandated the adoption of the Electronic Invoicing System (EIS) for certain taxpayers, including large businesses and exporters. While the initial rollout targeted these groups, the system is expected to expand to other sectors, potentially encompassing food businesses and restaurants. The EIS requires businesses to issue electronic invoices and receipts, streamlining tax reporting and enhancing transparency.

6. Imposition of VAT on digital services.

With the enactment of Republic Act No. 12023, the BIR has imposed a Value-Added Tax (VAT) on digital services. This includes services such as online food delivery platforms, reservation systems, and other digital tools that restaurants commonly use. If your business utilizes or provides digital services, it's essential to understand how this affects your VAT obligations.

What Happens If You Don't Comply?

Non-compliance with the new invoicing rules can lead to penalties, fines, or disqualification from tax-related benefits. The BIR has increased monitoring efforts, and businesses that continue issuing official receipts instead of invoices for taxable transactions risk being flagged during tax audits.

Now that you understand the key differences between sales invoices and official receipts, you can ensure your food business stays compliant with tax regulations. Stay updated with BIR announcements and local tax laws to avoid potential penalties and keep your operations running smoothly.